Working papers

Digital Infrastructure and Local Economic Development: Early Internet in Sub-Saharan Africa

with Moritz GoldbeckR&R at Journal of the European Economic Association

latest version here

CESifo Working Paper

job market paper

runner-up for the Distinguished CESifo Affiliate Award at the CESifo Area Conference on the Economics of Digitization 2022

Abstract

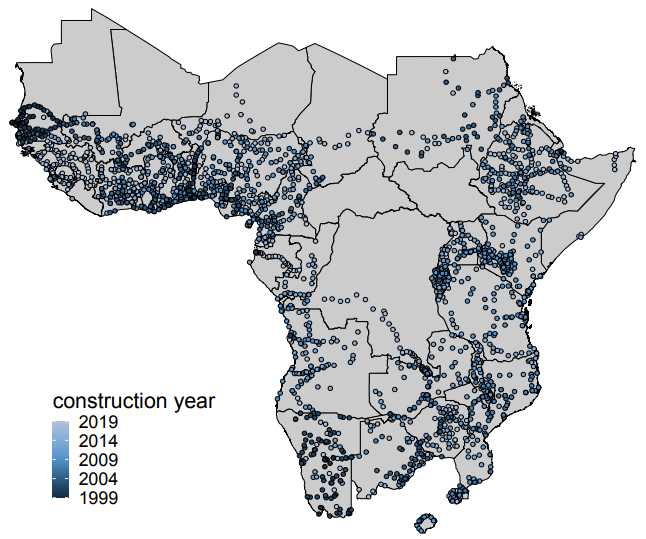

We investigate the impact of early internet availability at basic speeds on local economic development in remote areas of developing countries by analyzing nighttime light emissions across towns in Sub-Saharan Africa. Using a difference-in-differences approach, we exploit submarine cable arrivals, which established countrywide internet connections, and the rollout of the national backbones, which defines internet access within countries. Estimating on incidentally connected mid-sized towns, we find that early internet availability increases nighttime light intensity by 10 percent. We consider increased employment as the main explanation. Our findings highlight the importance of closing the digital divide for regional development.

JEL-Codes: L86, O18, O33, R11

Training, Automation, and Wages: International Worker-Level Evidence

with Oliver Falck, Yuchen Guo, Christina Langer, and Simon WiederholdR&R at Research Policy

latest version here

CESifo Working Paper

Abstract

Firm training is widely regarded as crucial for protecting workers from automation, yet there is a lack of empirical evidence to support this belief. Using internationally harmonized data from over 90,000 workers across 37 industrialized countries, we construct an individual-level measure of automation risk based on tasks performed at work. Our analysis reveals substantial within-occupation variation in automation risk, overlooked by existing occupation-level measures. To assess whether firm training mitigates automation risk, we exploit within-occupation and within-industry variation. Additionally, we employ entropy balancing to re-weight workers without firm training based on a rich set of background characteristics, including tested numeracy skills as a proxy for unobserved ability. We find that training reduces workers’ automation risk by 3.8 percentage points, equivalent to 8% of the average automation risk. The training-induced reduction in automation risk accounts for 15% of the wage returns to firm training. Firm training is effective in reducing automation risk and increasing wages across nearly all countries, underscoring the external validity of our findings. Training is similarly effective across gender, age, and education groups, suggesting widely shared benefits rather than gains concentrated in specific demographic segments.

JEL-Codes: J24, J31, J61, O33

Should I Mail or Should I Go: Voting Behavior After a One-Time All-Postal Election

with Marius Kröpersubmitted

latest version here

CESifo Working Paper

Abstract

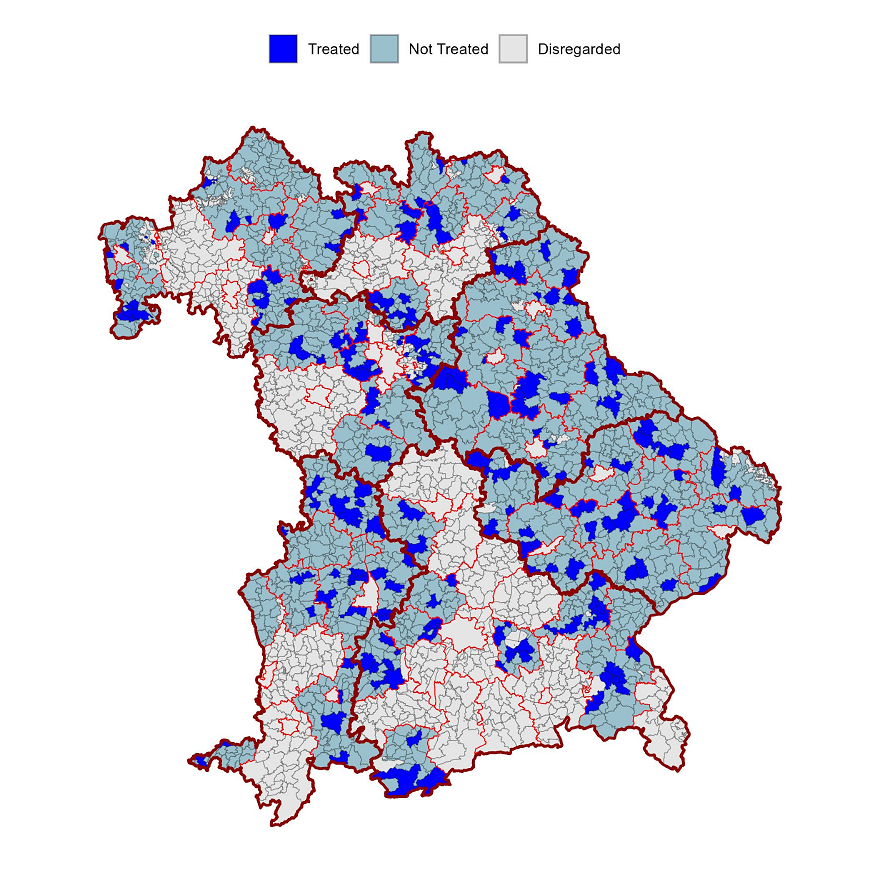

We investigate how reducing information costs through forced experimentation with postal voting, while holding administrative rules fixed, affects subsequent voting behavior. Leveraging a natural experiment during Bavaria’s 2020 Mayoral Elections and drawing on municipality-level administrative data spanning seven federal and state elections (2013-2025), we employ an event study design. We find a transitory increase in total turnout of 0.4 percentage points in the first election after the treatment, one and a half years later, and a persistent substitution from in-person to postal voting even five years after the treatment. Municipalities with a higher turnout in the past show larger effects. Investigating the distribution of information costs shows an age gradient, with the highest information costs in the oldest municipalities. The conservative governing party gains from higher postal turnout and other right-wing parties’ in-person voters.

JEL-Codes: D72, H70, D83

Involuntary Changes in Commuting Distances: Effects on Subjective Well-Being in the Era of Mobile Internet

with Katharina Bettigsubmitted

latest version here

CESifo Working Paper

Abstract

Commuting is a fundamental aspect of employees’ daily routines, yet its effects on subjective well-being are insufficiently investigated in the context of evolving digital connectivity. This paper investigates the causal effects of changes in commuting distance on subjective well-being in an era of widespread mobile internet access. Exploiting exogenous shifts in commuting distance resulting from employer-driven workplace relocations, we employ a Difference-in-Differences framework using data from the German Socio-Economic Panel (SOEP) from 2010 to 2019. Our results show that an involuntary increase in commuting distance significantly reduces life satisfaction by 3 percent, on average, and heightens feelings of worry by almost 8 percent, on average, with adaptation occurring only partially over time. Investigating the role of increased mobile coverage during commutes, we find that it, at least partially, mitigates declines in life satisfaction, whereas it intensifies the negative impact on satisfaction with leisure.

JEL-Codes: I31, J28, R40

Work in progress

Leapfrogging Telecommunication: Did the Roll-Out of Mobile Coverage Structurally Change Labor Markets?

with Marta BernardiKeywords: Mobile coverage, Structural transformation, Technological development

JEL-Codes: O33, O12, O14

Work from Home and Absenteeism

with Jean-Victor Alipour, Katharina Bettig, Kamila Cygan-Rehm, and Christian LeßmannKeywords: Work from home, Absenteeism, Sickness absence, Sick leave, Health

JEL-Codes: I10, J22

Polarizing the Polls: Candidate Ideology and Electoral Engagement

with Klara LehmannKeywords: Turnout, Local elections, Polarization, Right-wing populism, Salience, Thuringia

JEL-Codes: D72, P16, H70, D83

Cloudy with a Chance of Laziness: Voting Effects from the First East German Bundestag Election

with Sarah ListabarthKeywords: German reunification, Electoral behavior, Persistance, Institutional change, First free elections

JEL-Codes: D72, P16, P36, N93